Description

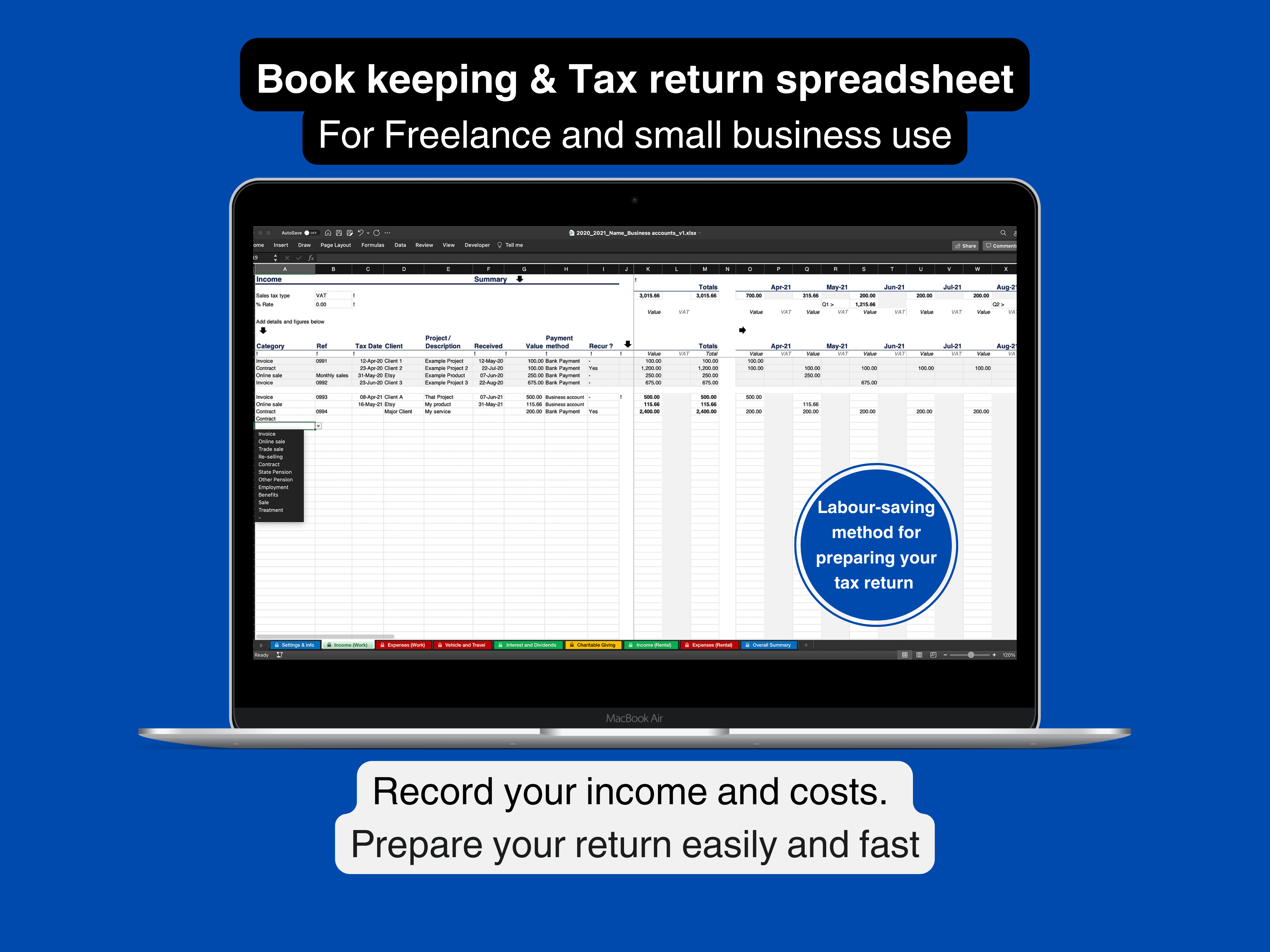

Tax return bookkeeping spreadsheet for freelancers. Record your freelance tax return information with ease. Easy to use system for recording Income & Expenses for Self-Employment, Vehicle & Travel, Rental Property. See your Income Tax & N.I. update as you add figures.

Log your income and expenses and prepare your tax-return information in the process. Spread the work over the year. Complete your return promptly when the tax year ends. Avoid the horror of pulling together a year of figures as the deadline looms.

Makes it easy to track back through your records to locate income and outgoings by date, bank account, client or project.

Features

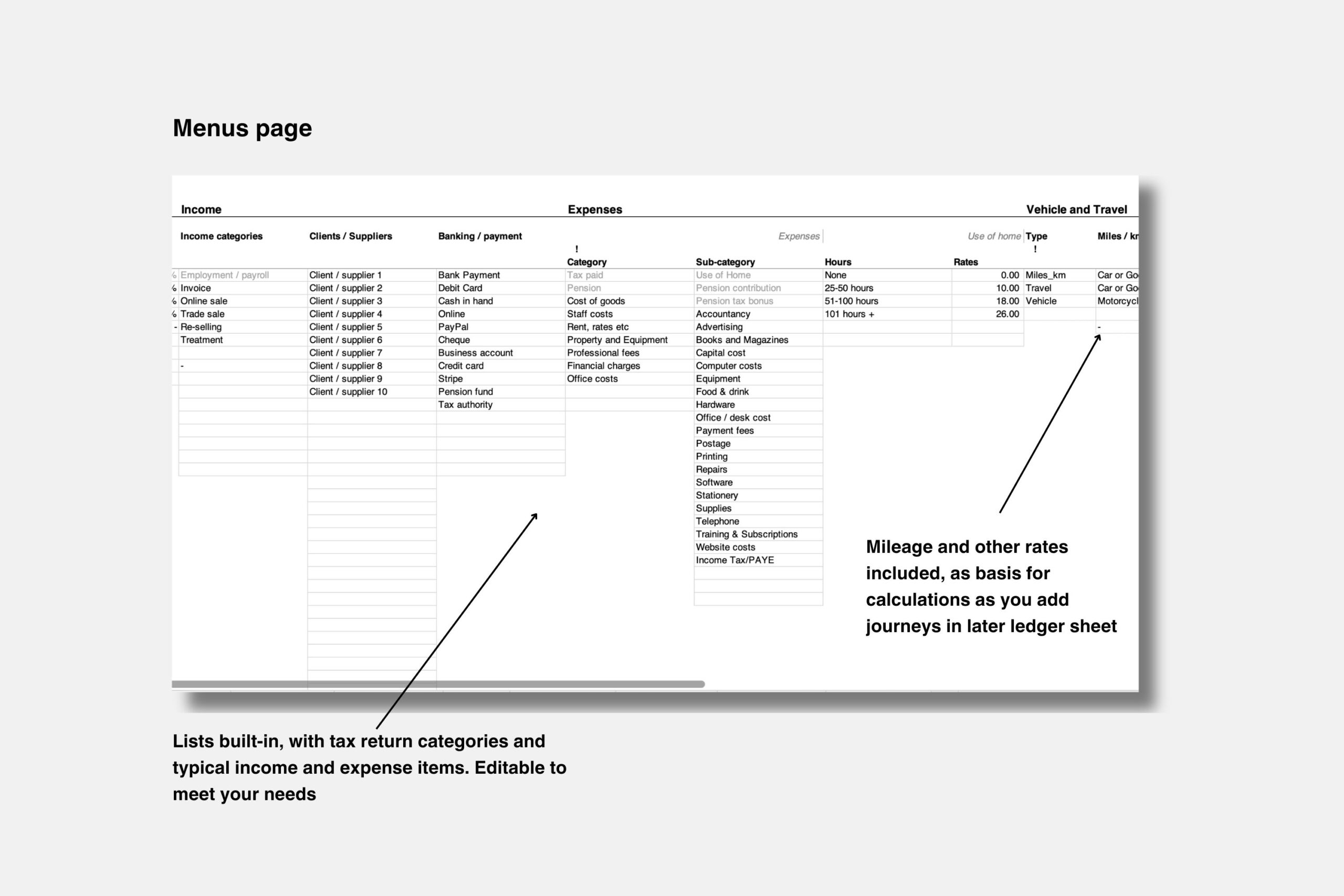

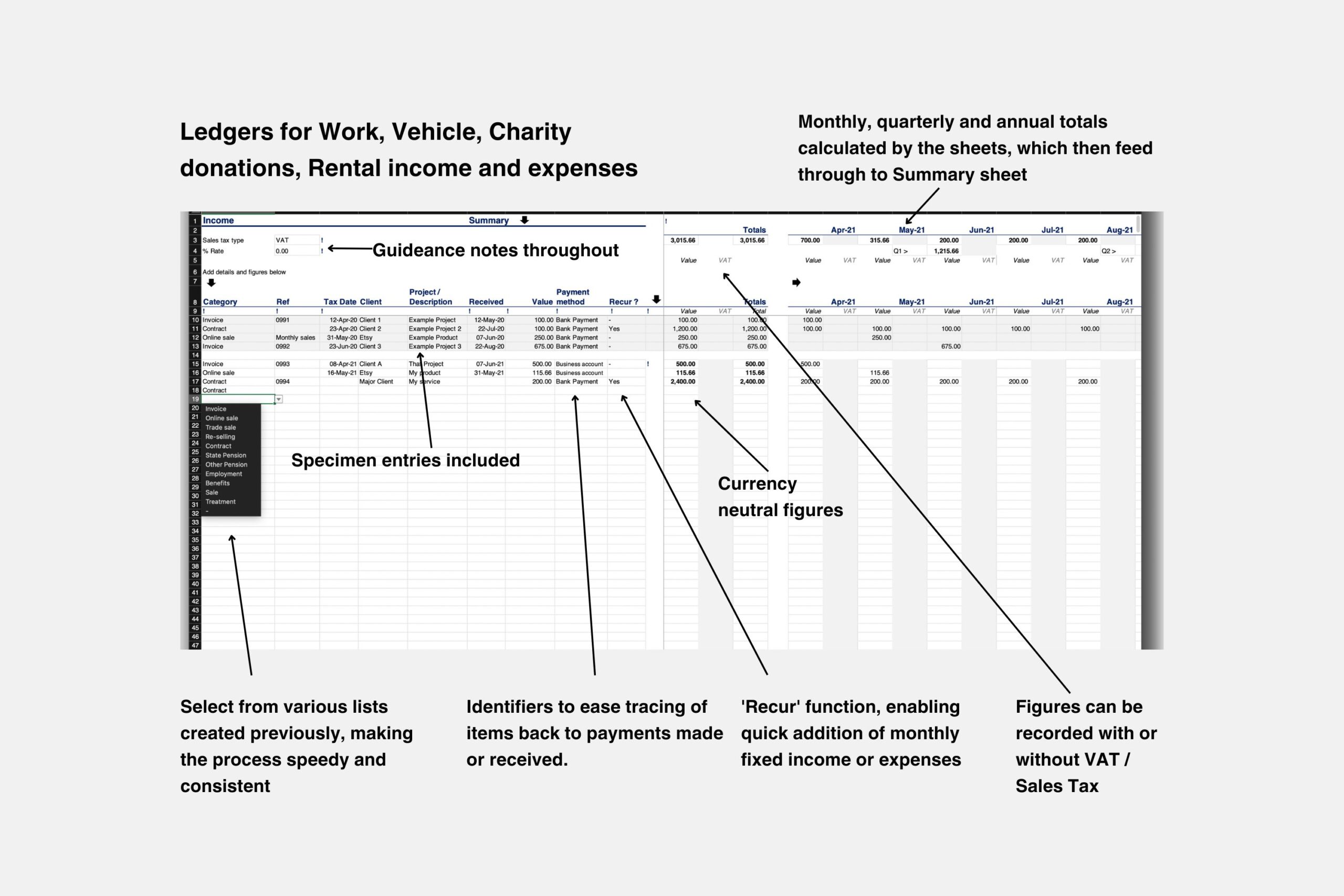

- Tabs for recording Income, Expenses, Charitable Donations, Savings Interest, Rental income and Rental property costs.

- Pull-down lists to record income and expenses under categories which cross-reference to the structure of the Self-Assessment tax return.

- Identifiers to ease tracing of items back to payments made or received, for future reference.

- ‘Recur’ function, enabling quick addition of monthly fixed income, expenses or donations, such as for software or other subscriptions, retainer income and such.

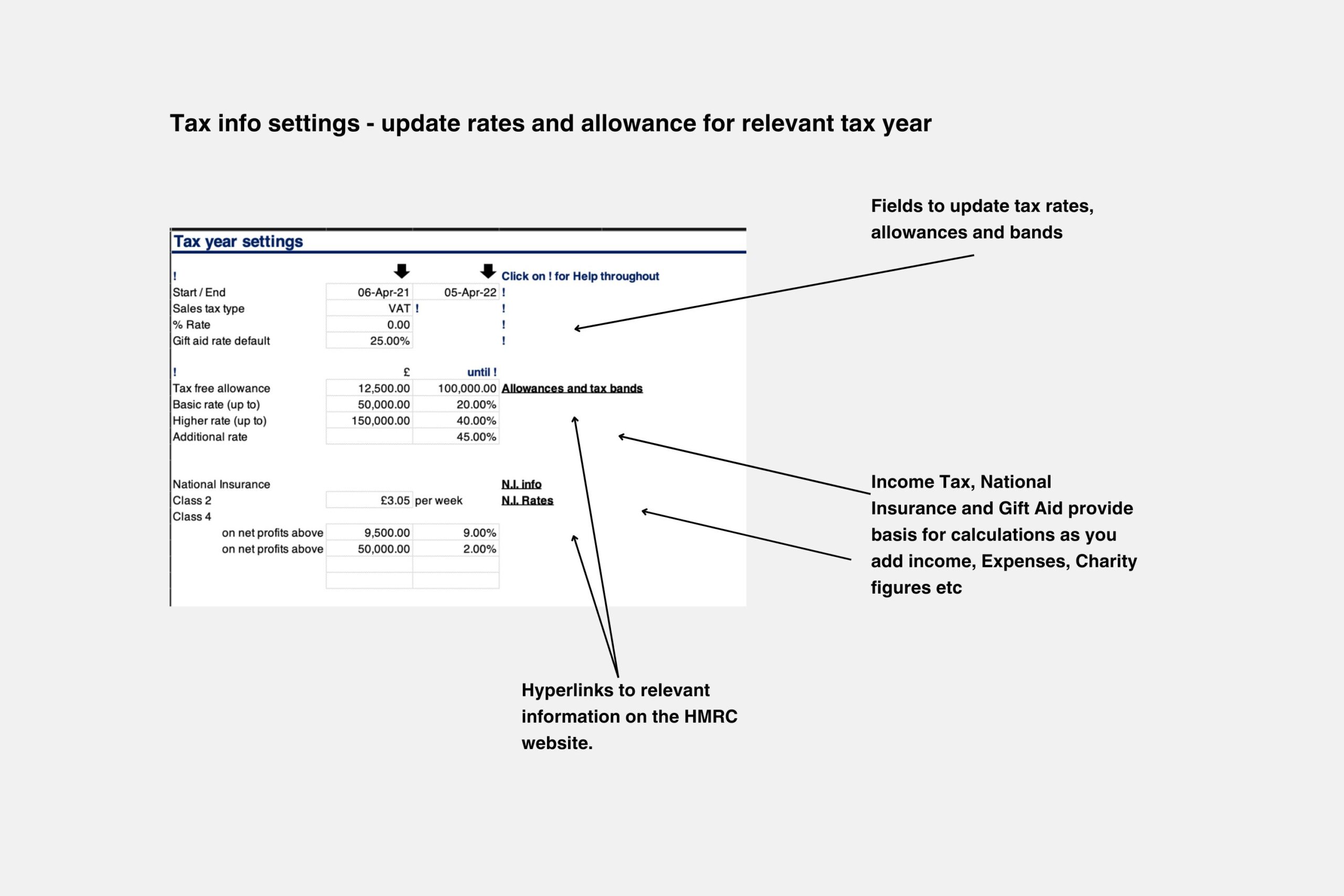

- Fields to update tax rates, allowances, tax bands, mileage and other rates, so template can be used for each subsequent tax year.

- Hyperlinks to relevant information on the HMRC website.

- Option to include or exclude VAT.

- Template provided with folder structure to collate receipts, invoices, statements and other documentation.

Calculations provided

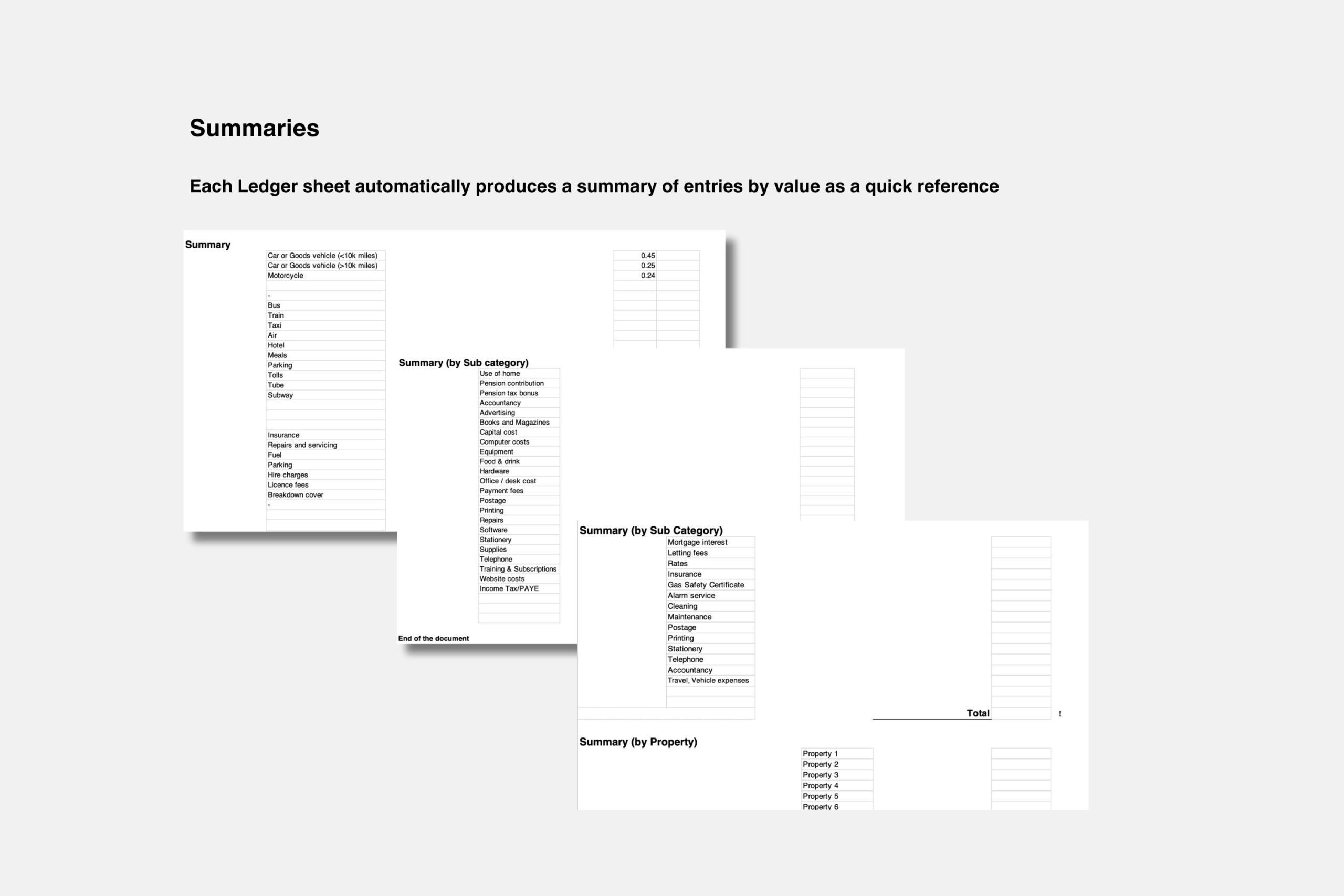

- Monthly and quarterly running totals.

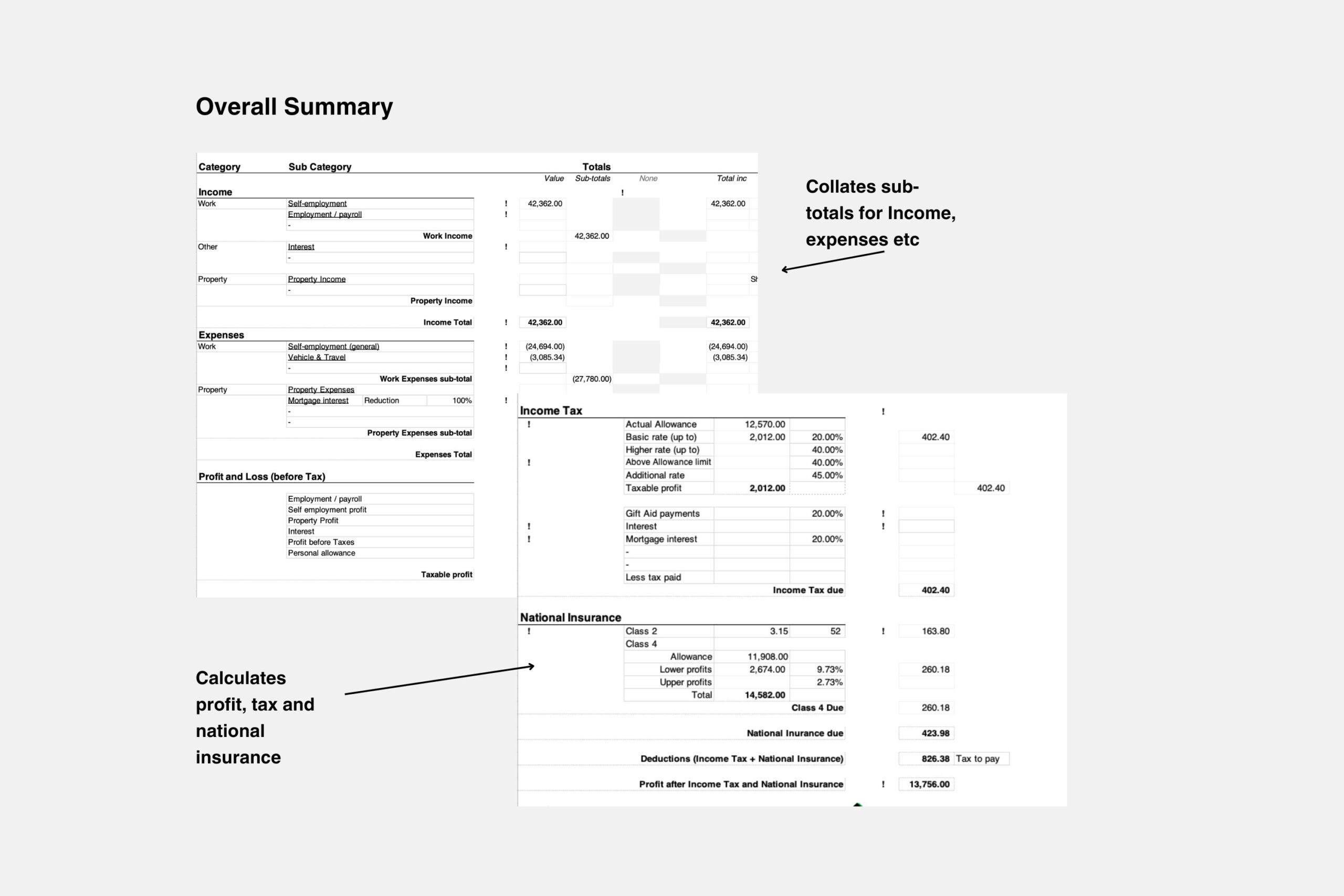

- Summary sheet including calculations of sub-totals, Income Tax (up to income of 100k), National Insurance (Class 2 and 4) estimates.

Built-in calculators for mileage and Work from home costs.

Updates for July 2023:

- Facility to add Employment income, tax deducted at source, as well as self-employment income

- Add Pension contributions and tax bonus (will be added to tax band ceiling as per UK self assessment tax return)

Technical spec / Compatibility

The spreadsheet is supplied as a Microsoft Excel template. Digital product. No physical material will be supplied.

Reviews

There are no reviews yet.